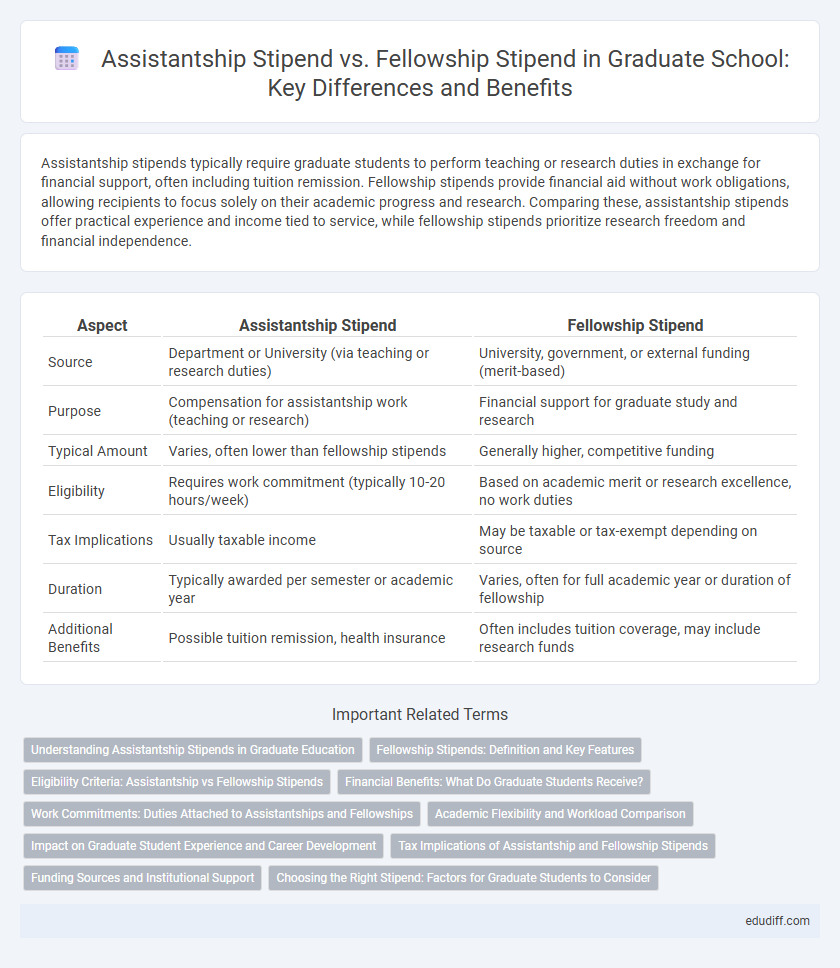

Assistantship stipends typically require graduate students to perform teaching or research duties in exchange for financial support, often including tuition remission. Fellowship stipends provide financial aid without work obligations, allowing recipients to focus solely on their academic progress and research. Comparing these, assistantship stipends offer practical experience and income tied to service, while fellowship stipends prioritize research freedom and financial independence.

Table of Comparison

| Aspect | Assistantship Stipend | Fellowship Stipend |

|---|---|---|

| Source | Department or University (via teaching or research duties) | University, government, or external funding (merit-based) |

| Purpose | Compensation for assistantship work (teaching or research) | Financial support for graduate study and research |

| Typical Amount | Varies, often lower than fellowship stipends | Generally higher, competitive funding |

| Eligibility | Requires work commitment (typically 10-20 hours/week) | Based on academic merit or research excellence, no work duties |

| Tax Implications | Usually taxable income | May be taxable or tax-exempt depending on source |

| Duration | Typically awarded per semester or academic year | Varies, often for full academic year or duration of fellowship |

| Additional Benefits | Possible tuition remission, health insurance | Often includes tuition coverage, may include research funds |

Understanding Assistantship Stipends in Graduate Education

Assistantship stipends in graduate education provide financial support to students in exchange for research, teaching, or administrative duties, typically ranging from $15,000 to $30,000 annually depending on the institution and discipline. These stipends often include benefits such as tuition remission and health insurance, distinguishing them from fellowships that primarily offer funding without work obligations. Understanding the structure and expectations of assistantship stipends helps graduate students balance academic responsibilities with financial stability throughout their program.

Fellowship Stipends: Definition and Key Features

Fellowship stipends are financial awards granted to graduate students to support their academic pursuits without requiring specific employment duties, unlike assistantship stipends tied to teaching or research responsibilities. These stipends often provide higher amounts and greater flexibility, allowing recipients to focus solely on their studies or research projects. Key features include tax exemption in some cases, fixed duration aligned with academic terms, and eligibility criteria based on merit or academic excellence.

Eligibility Criteria: Assistantship vs Fellowship Stipends

Assistantship stipends typically require graduate students to engage in teaching or research duties, with eligibility contingent on enrollment status and departmental availability. Fellowship stipends are awarded based on academic merit or research potential, often without work obligations, and eligibility may depend on specific program or funding agency criteria. Both stipends aim to support graduate studies but differ significantly in commitment requirements and qualification standards.

Financial Benefits: What Do Graduate Students Receive?

Graduate students receive varying financial benefits depending on whether they are awarded an assistantship stipend or a fellowship stipend. Assistantship stipends typically include a monthly salary in exchange for teaching, research, or administrative duties, often coupled with tuition waivers and health insurance benefits. Fellowship stipends usually provide a fixed amount of funding intended to support the student's academic focus without work responsibilities, which may also include tuition coverage but generally lack additional employment benefits.

Work Commitments: Duties Attached to Assistantships and Fellowships

Graduate assistantship stipends typically require specific work commitments such as teaching, research, or administrative duties that support academic departments, emphasizing direct contributions to the university's mission. Fellowship stipends, in contrast, generally provide financial support without mandatory work obligations, allowing recipients to focus primarily on their own research or study. Understanding the balance between financial support and work responsibilities is crucial for graduate students when evaluating assistantship versus fellowship opportunities.

Academic Flexibility and Workload Comparison

Assistantship stipends often require specific work commitments such as teaching or research duties, limiting academic flexibility due to assigned responsibilities. Fellowship stipends typically provide greater freedom to focus on research or coursework without structured work hours, enhancing the ability to manage academic goals independently. Comparing workloads, assistantships entail consistent time obligations, whereas fellowships allow flexible scheduling aligned with personal academic progress.

Impact on Graduate Student Experience and Career Development

Assistantship stipends typically provide graduate students with practical teaching or research experience, directly enhancing professional skills and networking opportunities crucial for career advancement. Fellowship stipends offer financial support without work obligations, allowing students to concentrate fully on academic research and personal development, which can lead to higher scholarly productivity. Both funding types influence graduate student experience uniquely, with assistantships fostering applied experience and fellowships promoting focused academic growth essential for diverse career paths.

Tax Implications of Assistantship and Fellowship Stipends

Graduate assistantship stipends are often considered taxable income by the IRS unless they are used strictly for qualified educational expenses like tuition and fees, whereas fellowship stipends may be tax-free if used solely for such qualified expenses. Tax implications vary based on how the funds are allocated and reported on tax returns, with assistantship income typically subject to withholding and fellowship stipends requiring careful documentation to avoid taxation. Understanding the tax treatment of each stipend type is crucial for graduate students to optimize their financial aid benefits and comply with tax regulations.

Funding Sources and Institutional Support

Assistantship stipends are typically funded through departmental budgets or grants awarded to faculty members, reflecting direct institutional support tied to specific job responsibilities such as research or teaching. Fellowship stipends are generally provided by external funding agencies or university endowments, offering financial support without work obligations, thereby encouraging focused academic or research advancement. Institutional support for assistantships often includes tuition remission and health benefits, whereas fellowships primarily emphasize financial independence and prestige.

Choosing the Right Stipend: Factors for Graduate Students to Consider

Graduate students should evaluate assistantship stipends, which often include teaching or research duties with a fixed monthly payment, against fellowship stipends that provide funding without work obligations but may lack health benefits. Factors such as stipend amount, duration, associated responsibilities, health insurance coverage, and tax implications heavily influence the decision. Understanding the total compensation package and long-term career goals is crucial for selecting the optimal financial support during graduate studies.

Assistantship Stipend vs Fellowship Stipend Infographic

edudiff.com

edudiff.com