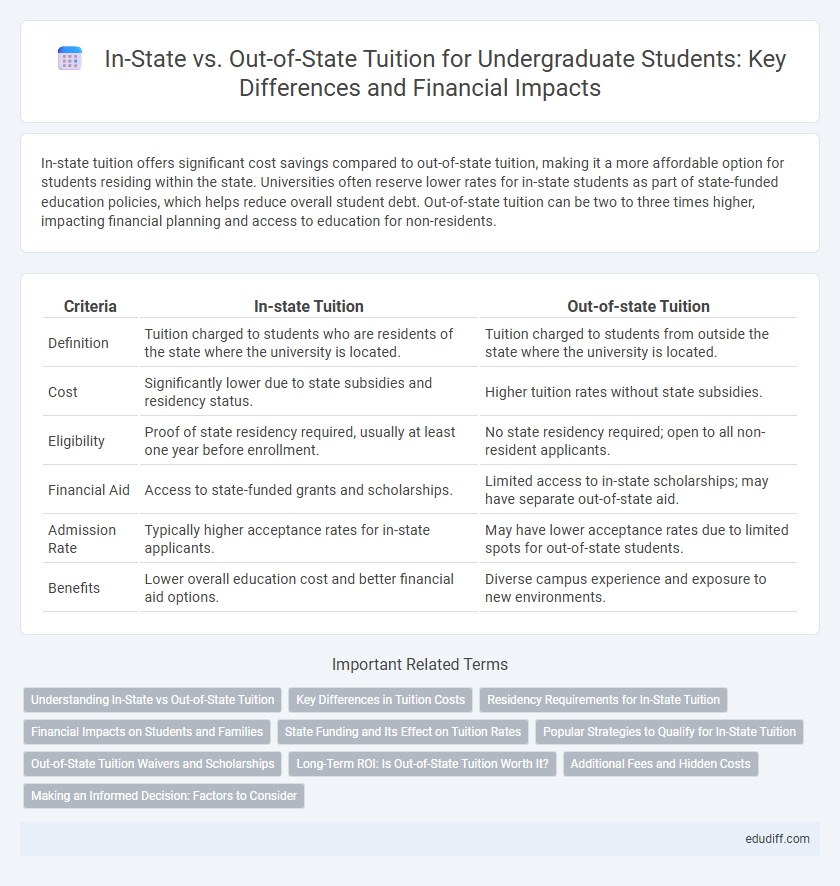

In-state tuition offers significant cost savings compared to out-of-state tuition, making it a more affordable option for students residing within the state. Universities often reserve lower rates for in-state students as part of state-funded education policies, which helps reduce overall student debt. Out-of-state tuition can be two to three times higher, impacting financial planning and access to education for non-residents.

Table of Comparison

| Criteria | In-state Tuition | Out-of-state Tuition |

|---|---|---|

| Definition | Tuition charged to students who are residents of the state where the university is located. | Tuition charged to students from outside the state where the university is located. |

| Cost | Significantly lower due to state subsidies and residency status. | Higher tuition rates without state subsidies. |

| Eligibility | Proof of state residency required, usually at least one year before enrollment. | No state residency required; open to all non-resident applicants. |

| Financial Aid | Access to state-funded grants and scholarships. | Limited access to in-state scholarships; may have separate out-of-state aid. |

| Admission Rate | Typically higher acceptance rates for in-state applicants. | May have lower acceptance rates due to limited spots for out-of-state students. |

| Benefits | Lower overall education cost and better financial aid options. | Diverse campus experience and exposure to new environments. |

Understanding In-State vs Out-of-State Tuition

In-state tuition is typically lower because it is subsidized by the resident state's tax revenue, while out-of-state tuition is higher to offset the lack of such subsidies. Universities often classify students as in-state based on criteria like residency duration, tax filings, and intent to remain in the state. Understanding these distinctions helps prospective undergraduates budget effectively and explore eligibility for in-state rates through residency establishment.

Key Differences in Tuition Costs

In-state tuition typically costs significantly less than out-of-state tuition due to state subsidies that reduce the financial burden for residents, often resulting in savings of 40-70%. Public universities charge out-of-state students higher rates to offset the lack of state tax contributions, which can reach double or more the price of in-state tuition. These cost differences greatly influence college affordability and financial planning for undergraduate students and their families.

Residency Requirements for In-State Tuition

Residency requirements for in-state tuition typically mandate that students or their families must have lived in the state for at least 12 consecutive months before enrollment, demonstrating intent to establish permanent domicile rather than temporary residence for education. Documentation such as state tax returns, voter registration, driver's licenses, and proof of employment or financial independence is often required to verify residency status. Meeting these criteria significantly reduces tuition costs compared to out-of-state rates, which can be two to three times higher, impacting an undergraduate's overall education expense planning.

Financial Impacts on Students and Families

In-state tuition typically costs significantly less than out-of-state tuition, often saving students and families thousands of dollars annually, which can reduce reliance on student loans and minimize long-term debt. Financial impacts include not only direct tuition fees but also varied expenses such as residency requirements, scholarships eligibility, and state-funded grants accessible primarily to in-state students. Understanding these cost differences is crucial for budgeting, financial planning, and making informed decisions about college affordability and access.

State Funding and Its Effect on Tuition Rates

State funding significantly reduces in-state tuition rates by subsidizing the cost of education for residents, making public universities more affordable. Out-of-state students pay higher tuition because they do not benefit from these state subsidies, reflecting the full cost of instruction. Variations in state budgeting and priorities directly influence the gap between in-state and out-of-state tuition fees.

Popular Strategies to Qualify for In-State Tuition

Qualifying for in-state tuition often involves establishing residency by maintaining a physical presence in the state for at least 12 months prior to enrollment, demonstrating intent to remain through state-issued identification and voter registration. Many students secure part-time or full-time employment within the state while filing state income taxes as residents to strengthen their residency claim. Other strategies include enrolling in state-sponsored programs, seeking tuition reciprocity agreements, or obtaining financial aid designated for in-state students.

Out-of-State Tuition Waivers and Scholarships

Out-of-state tuition waivers and scholarships significantly reduce the financial burden for non-resident undergraduate students, often covering partial or full tuition costs. Many public universities offer specific out-of-state scholarships based on academic merit, athletic ability, or residency in neighboring states to encourage enrollment. Securing these financial aids requires early application and maintaining certain GPA requirements, making them competitive yet valuable options to lower overall education expenses.

Long-Term ROI: Is Out-of-State Tuition Worth It?

Out-of-state tuition typically costs two to three times more than in-state rates, but it often grants access to higher-ranked universities with stronger alumni networks and better career services. Graduates from out-of-state institutions may experience higher starting salaries and improved job placement, which can offset the initial financial investment over a 10- to 20-year period. Evaluating long-term ROI involves comparing total debt, salary growth, and employment opportunities tied to the reputation and resources of out-of-state schools versus the affordability of in-state tuition.

Additional Fees and Hidden Costs

In-state tuition typically offers lower base rates compared to out-of-state tuition, but additional fees such as technology, activity, and lab charges can significantly increase the total cost for both categories. Out-of-state students often face higher mandatory fees and residency verification expenses, creating hidden costs that surpass the advertised tuition rates. Careful examination of the university's fee structure and potential hidden expenses is crucial for accurately budgeting undergraduate education.

Making an Informed Decision: Factors to Consider

Evaluate residency status carefully because in-state tuition rates often cost 50-75% less than out-of-state tuition, significantly impacting overall college affordability. Consider financial aid opportunities, as some scholarships are reserved for in-state students and can reduce expenses further. Assess long-term benefits such as networking prospects within the state, potential state-specific internship programs, and future career opportunities that align with attending a local university.

In-state Tuition vs Out-of-state Tuition Infographic

edudiff.com

edudiff.com